Credit Card transactions value in Chile

Number of Debit Cards in Chile

At the close of Q4 2023, the total number of debit cards in Chile reached 27.3 million, reflecting an impressive growth of 8.9% compared to the end of 2022. The annual growth in debit transactions for the year 2023 was notable, standing at 18.8%, with a 6.9% increase in transaction volume.

In contrast, the number of credit cards experienced a year-on-year contraction of 7%, totaling nearly 16 million cards among banking institutions, financial entities, and non-banking companies by the end of 2023. However, the number of credit transactions showed an annual growth of 8.7%, and the nominal transaction volume in Pesos increased by 6.5% compared to 2022. This growth in transactions and volume was primarily driven by purchases and charges, while a significant 11% year-on-year contraction in cash advances dampened the overall growth rate.

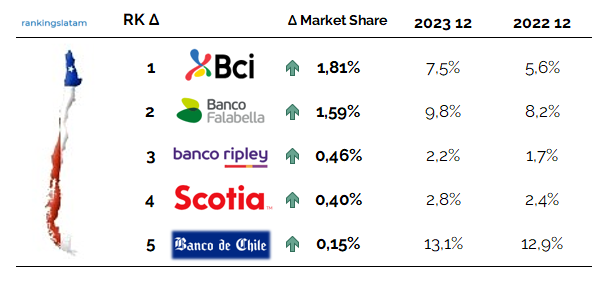

The growth ranking in market share for the quantity of debit cards places BCI in the lead with a remarkable +1.81 percentage points gained, comparing December 2023 to December 2022. Banco Falabella (+1.59), Banco Ripley (+0.46), Scotiabank (+0.40), and Banco de Chile (+0.15) comprised the top five competitors in this indicator.

In terms of market share by number of debit cards, Banco del Estado de Chile maintains a clear dominance with 51% of the market, followed by Banco de Chile with 13% and Banco Falabella with 9.8%.

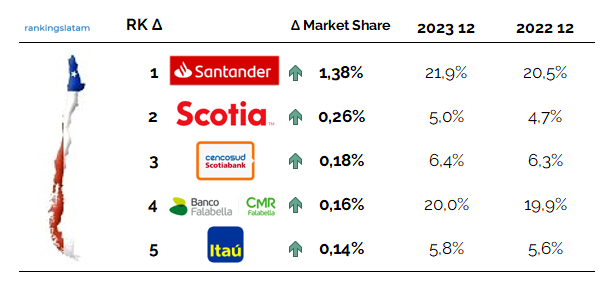

When it comes to the volume of credit card transactions, Santander Chile takes the lead in market share growth with an advancement of +1.38 market share points. Scotiabank (+0.26), Cencosud (+0.18), CMR-Falabella (+0.16), and ITAU (+0.14) followed with also great performances during 2023.

In terms of market share, considering the number of credit cards, Banco Falabella retains its leadership, followed by Cencosud-Scotiabank and Santander. In the non-banking cards sector, Tricard, Solventa, and LP are the top competitors on the podium.

Out of a total of 17 credit card brands, Mastercard and Visa maintain a clear dominance, collectively holding 87% of the market at the close of December 2023.

In contrast, the number of credit cards experienced a year-on-year contraction of 7%, totaling nearly 16 million cards among banking institutions, financial entities, and non-banking companies by the end of 2023. However, the number of credit transactions showed an annual growth of 8.7%, and the nominal transaction volume in Pesos increased by 6.5% compared to 2022. This growth in transactions and volume was primarily driven by purchases and charges, while a significant 11% year-on-year contraction in cash advances dampened the overall growth rate.

The growth ranking in market share for the quantity of debit cards places BCI in the lead with a remarkable +1.81 percentage points gained, comparing December 2023 to December 2022. Banco Falabella (+1.59), Banco Ripley (+0.46), Scotiabank (+0.40), and Banco de Chile (+0.15) comprised the top five competitors in this indicator.

In terms of market share by number of debit cards, Banco del Estado de Chile maintains a clear dominance with 51% of the market, followed by Banco de Chile with 13% and Banco Falabella with 9.8%.

When it comes to the volume of credit card transactions, Santander Chile takes the lead in market share growth with an advancement of +1.38 market share points. Scotiabank (+0.26), Cencosud (+0.18), CMR-Falabella (+0.16), and ITAU (+0.14) followed with also great performances during 2023.

In terms of market share, considering the number of credit cards, Banco Falabella retains its leadership, followed by Cencosud-Scotiabank and Santander. In the non-banking cards sector, Tricard, Solventa, and LP are the top competitors on the podium.

Out of a total of 17 credit card brands, Mastercard and Visa maintain a clear dominance, collectively holding 87% of the market at the close of December 2023.