The latest data regarding credit service clients in Brazil for the third quarter of 2023 has provided valuable insights into the market trends and competitive landscape. Let's delve into the key findings:

The total number of active credits in Brazil reached an impressive 269.3 million by the end of 2023.Q3, marking a noteworthy annual growth rate of 8.6%. This surge signifies a robust expansion in credit utilization within the country.

Also, the volume of credit operations, including placements, renewals, and revolving transactions, soared to 687.5 million, demonstrating a substantial 12% increase compared to the same period in 2022.Q3. This uptick underscores the growing demand for credit facilities among consumers and retail businesses alike.

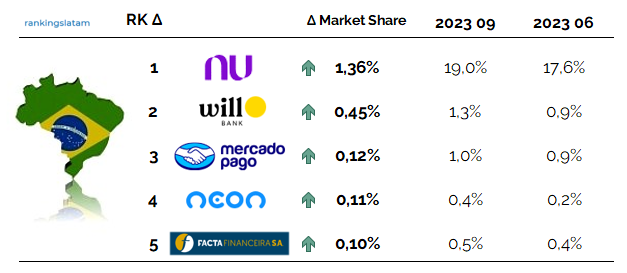

Market share growth ranking (Active loans)

Nubank secured the top position with an impressive growth of 1.36 in market share. Will Bank follows closely behind with a notable increase of 0.45. Mercado Pago exhibited steady growth with a rise of 0.12. Neon and Facta also experienced commendable growth rates of 0.11 and 0.10 market share points, respectively.

Market share growth ranking (Transactions)

Nubank maintained its dominance by achieving a remarkable growth of 2.33 in market share. BTG Pactual emerged as a strong contender with a notable increase of 0.32. Will Bank closely trailed behind with a growth of 0.31. Inter and Banco Mercantil demonstrated significant improvements with growth rates of 0.17 and 0.16, respectively.

In conclusion, the latest rankings underscore the dynamic nature of Brazil's credit service sector, with several neo-banks and fintech key players vying for market dominance through strategic growth initiatives.