The credit card market in Argentina has witnessed fierce competition in recent years. According our latest market report, the market size in terms of US dollars considering the AR$/USD formal exchange rate increased from USD 40,178 million in 2021 to USD 44,447 million in 2022. The forecast for 2025 assuming a macroeconomic environment that, although it continues to have major problems, does not lead to a severe crisis, suggests further growth, with a projected market size of USD 48,767 million. It is important to take into account that the market size is practically reduced by half if the unofficial exchange rate is considered.

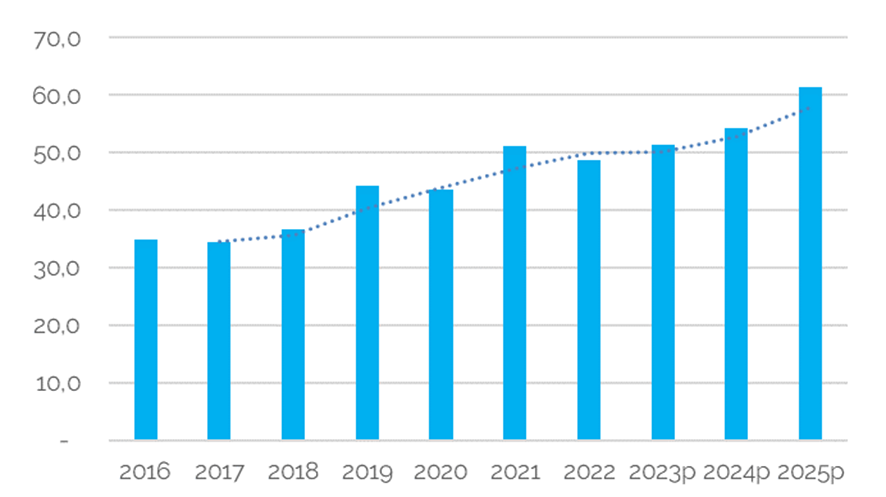

Active credit cards in Argentina - YoY% (2016-2022/2023e-2025e)

On the other hand, the number of active credit cards in Argentina also saw a significant increase. In 2022, there were 25,4 million active credit cards, compared to 23,4 million in 2021. Despite the slight decrease in the average number of purchases per card from 51.1 in 2021 to 48.7 in 2022, credit card transactions remained robust. In 2022, there were 1238 million credit card transactions, compared to 1196 million in the previous year. This indicates a continued reliance on credit cards for day-to-day purchases.

Transactions per credit card average in Argentina - YoY% (2016-2022/2023e-2025e)

In terms of market share, the top five issuers by outstanding credit card receivables dominated the credit card landscape. Banco de Galicia held the largest share with 15.2%, followed closely by Banco Santander 13.9%. Banco BBVA Argentina, Banco de la Nación Argentina, and Banco Macro also held significant market shares of 12.5%, 11.1%, and 8.8%, respectively.

Source: