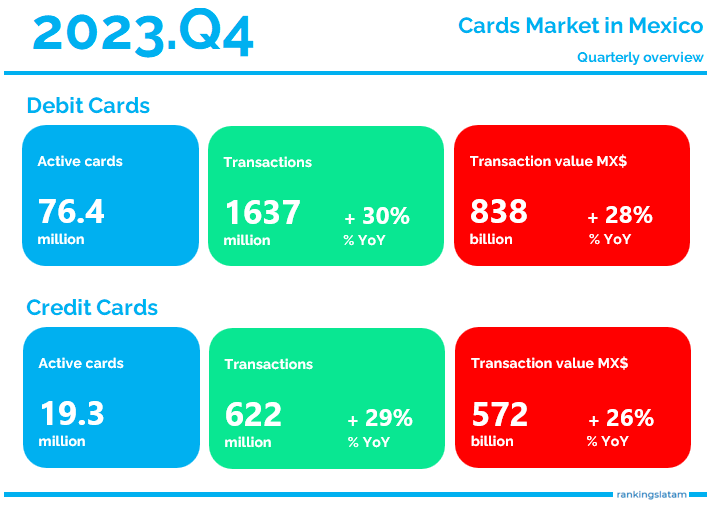

As of the conclusion of December 2023, the Mexican credit card market boasted 19.3 million active cards out of a total issuance of 31.6 million cards. Concurrently, active debit cards reached 76.4 million, accounting for almost half of the nearly 155 million cards in circulation.

When examining all current bank cards, encompassing both credit and debit, the distribution revealed that 58% belonged to VISA, 41% to MASTERCARD, with the remaining percentage attributed to various other brands.

In terms of transaction volumes, the conclusion of Q4 2023 showcased a remarkable interannual growth rate of 30%, resulting in 1,637 million debit cards transactions and 622 million with credit cards.

Analyzing transaction values in Mexican pesos, the debit card market demonstrated a robust year-on-year growth rate of 28%, reaching a total of MX$ 838 billion in the quarter. Conversely, credit card transactions witnessed a 26% variation, amounting to MX$ 572 billion.

At the conclusion of December 2023, a detailed examination of credit card spending across consumption categories revealed that Retail experienced the most significant year-on-year increase in its relative weight, advancing by 1.62 share points. Following closely were consumption categories associated with insurance companies (+0.88), restaurants (+0.85), and educational expenses (+0.49).

Debit Cards speding categories growth ranking

Debit card spending, on the other hand, demonstrated noteworthy increases in the relative weight of consumption categories, with purchases in large stores leading the way with a remarkable +2.17, followed by purchases in retailers (+1.50) and expenses in restaurants (+0.2).

Combining spending in large stores and retailers, these two categories collectively represented 51.2% of total debit card expenditures and 37.6% of credit card spending in December 2023.