Bank´s profitability performance in Peru - Top 5 ranking

In Peru, banking entities reported a Net Income of S$ 9,226 million at the close of 2023.Q4, reflecting a 9% decline compared to the S$ 10,119 million recorded at the close of 2022. When measured in USD, the total Net Income amounts to USD 2,486 million, representing a 6.3% decrease from 2022.

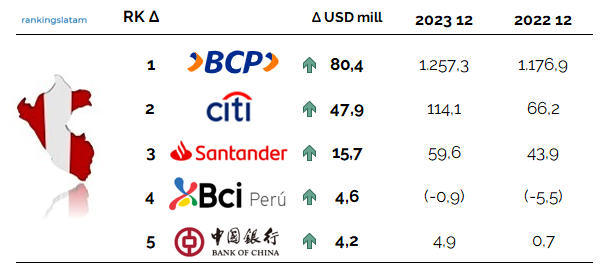

Leading the ranking of banking entities with the most significant improvement in Net Income, measured in USD, is BCP, demonstrating a year-over-year improvement of USD 80.4 million. Following closely are CITI, SANTANDER PERU, BCI PERU, and BANK OF CHINA PERU.

Considering the total assets, BCP maintains its leadership with a 35% market share, followed by BBVA PERU with 20.4% and SCOTIABANK with 13.8%. In terms of the highest year-over-year growth in assets, BBVA PERU takes the top spot with an advancement of +0.9 percentage points, followed by SANTANDER PERU (+0.5 points) and BANCO INTERAMERICANO (+0.3 points).

SANTANDER led in year-over-year growth in deposits, while BBVA PERU secured the first position in the total loan portfolio, followed by INTERBANK.

Summary of the sector's metrics (2023.Q4 vs. 2022.Q4):

Total assets: USD 137,726 million (+4.5%)

Loan portfolio: USD 88,282 million (+0.7%)

Deposits: USD 89,531 million (+5.6%)

Total income: USD 12,363 million (+25%)

Capital (Net Equity): USD 18,261 million (+12.3%)

Pre-tax income: USD 3,233 million (-9%)

Net Profit: USD 2,486 million (-6.4%)

Leading the ranking of banking entities with the most significant improvement in Net Income, measured in USD, is BCP, demonstrating a year-over-year improvement of USD 80.4 million. Following closely are CITI, SANTANDER PERU, BCI PERU, and BANK OF CHINA PERU.

Considering the total assets, BCP maintains its leadership with a 35% market share, followed by BBVA PERU with 20.4% and SCOTIABANK with 13.8%. In terms of the highest year-over-year growth in assets, BBVA PERU takes the top spot with an advancement of +0.9 percentage points, followed by SANTANDER PERU (+0.5 points) and BANCO INTERAMERICANO (+0.3 points).

SANTANDER led in year-over-year growth in deposits, while BBVA PERU secured the first position in the total loan portfolio, followed by INTERBANK.

Summary of the sector's metrics (2023.Q4 vs. 2022.Q4):

Total assets: USD 137,726 million (+4.5%)

Loan portfolio: USD 88,282 million (+0.7%)

Deposits: USD 89,531 million (+5.6%)

Total income: USD 12,363 million (+25%)

Capital (Net Equity): USD 18,261 million (+12.3%)

Pre-tax income: USD 3,233 million (-9%)

Net Profit: USD 2,486 million (-6.4%)